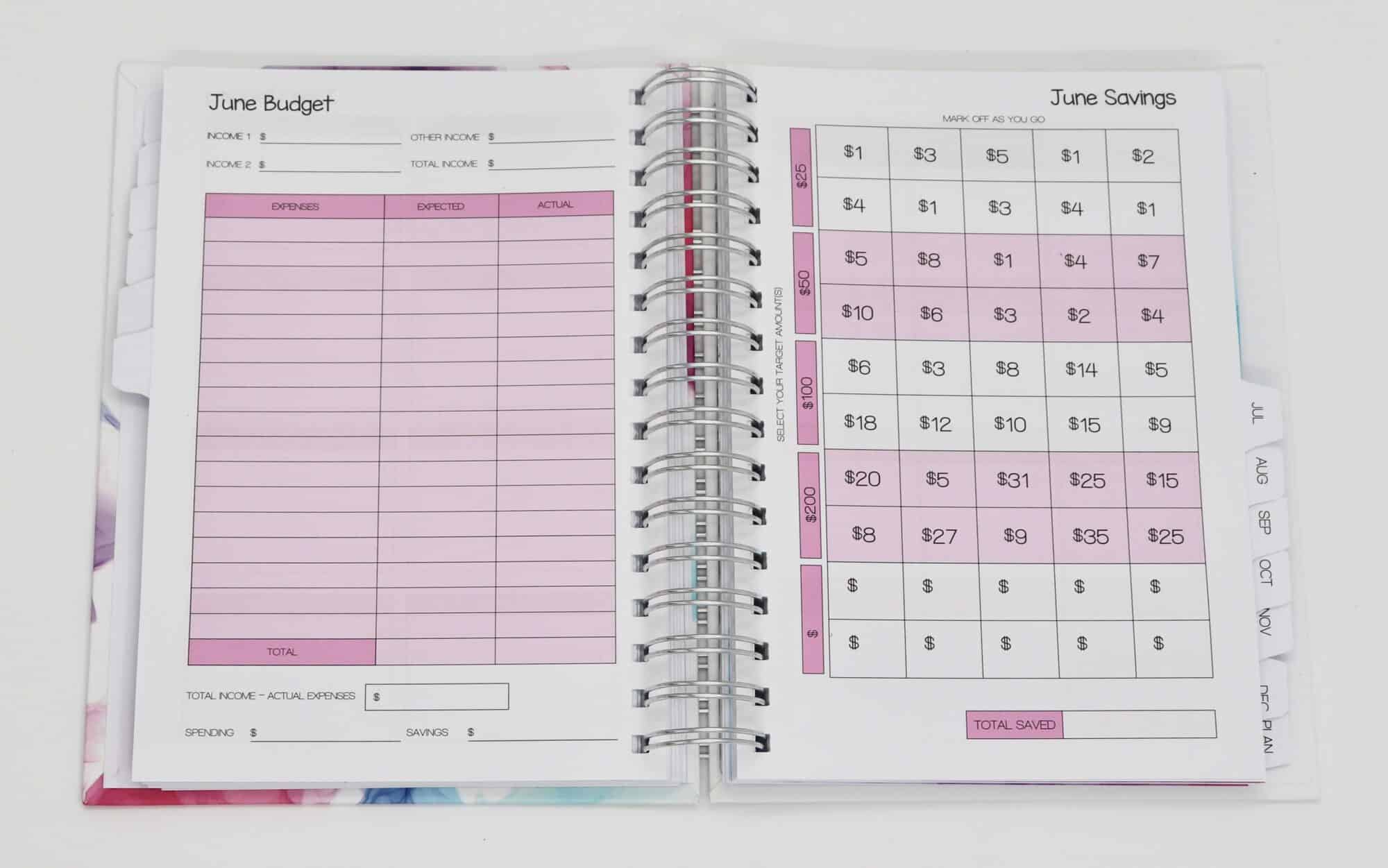

Creating an ideal budget is one thing but sticking to that budget is a completely different story!

Here’s my tips for helping you stick to your budget in 2022. These are methods I use or have personally used to ensure my family can meet our financial goals, consistently. feel free to share your tips in the comments below.

How You Access Your Money, Matters

If you don’t have an easy to use spending method then you may find that budget falling out the window much quicker than you expected, even in your worst case scenario! When deciding the best spending method for you and your family make sure you think about who’s using the money, where they use it and also how much time to want to invest into using your money (for me, that’s very very little haha).

One of the most common methods is the envelope system which I believe has many forms! here is a quick run down on how I have used this method and changed it to work for me.

Envelope system

Physical envelopes with cash inside for each expense.

The idea here is to label an envelope and insert the budget, in cash, into that envelope. when shopping you use only what’s in that envelope to pay. So you may have envelopes for cash expenses, groceries, school fees, etc.

when we tried this method many many years ago we quickly found that this would absolutely not work for us. We are a couple who share all money and both do grocery trips or spend money from other categories.

Some people swear by this method though so if you think it will work then it’s absolutely worth a go. If it doesn’t work, it doesn’t work!

Virtual Envelope System

When I used this I had the Good Budget app And I’d enter my expenses, which account they were paid from (virtual envelope) and the app would tell me how much I had left for what. This worked quite well for quite a long time. Certainly worth a go if it appeals to you. The negative is that it can be labour intensive in regards to data entry. Some apps import transactions from your bank though.

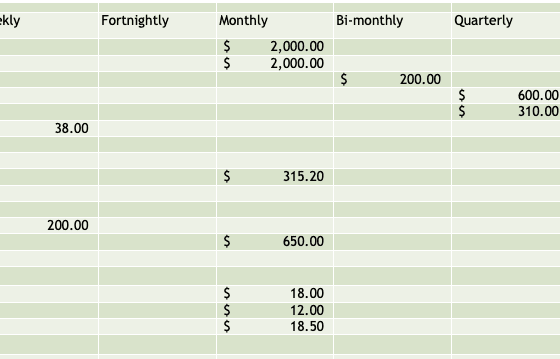

Bank Account Envelopes

This is another one I used for a long time. Back in the day when I banked with CBA I created an account for every type of expense and every pay I put in the required amount to cover that expense. So I had NetBank savers (because they didn’t attract fees) and labeled them things like “groceries” “car 1” “car 2” “home insurnace” etc. when I needed to pay for that expense I’d transfer money from the labeled account to our transaction account. It was easy but I did need to do those transfers and that’s why I moved away from this method.

Simplified Bank Envelope System

This is what I am currently using and it’s probably worked the best out of anything I’ve tried, with the least amount of effort required. It’s very simple! I opened a transaction account, with a card, for each category I needed to cover. For me that was spending, bills, groceries and essentials (medical and clothing). I had 4 cards and would put the amount required into the account each month and spend as necessary through the month. I’d just check the balance every few days, or the end of the month, to see where I was at.

I found the amount always covered what needed to be paid and it was extremely easy for hubby to follow along (who is absolutely not interesting in budgeting!).

Tips for this method: find a bank who won’t charge you fees. NAB and Macquarie currently both offer multiple free accounts which have cards.

Use categories which suit you! This is essential to getting this working. Some people often tell me they use similar to mine but also have one for car expenses like fuel and tyres.

If you want to read more about the Envelope system and similar financial methods which use variations, here are a few links.

The Barefoot Investor Buckets

Dave Ramsey’s Envelope System

Money Saving Mom’s Modified Envelope System

Get the family involved

Anyone who spends as a part of your budget should be included in the design or at least walked through it. In my house I do all the budgeting and then let hubby know how any changes work. This works for us but someone in your family may prefer to be more actively involved. I encourage you to roll with this as it will very likely mean the whole budget will be more successful over all.

Spending Money

If you are in a position to have spending money, make sure you do! This is probably a key factor in a successful budget, long term.

Most people would get fed up if they had to restrict spending to zero in the pursuit of a financial goal. To overcome this budget fatigue make sure you allow yourself some freedom to get coffee, lunch with friends, grab a 6 pack or enjoy a movie.

Over the years we have had very different levels of income. Our spending money reflects that and fluctuates as we require. At times it’s been $10 per week each. One system we used which worked really well was $150 a week and we split it into 3. $50 for me, $50 for hubby and $50 for a date (pre kids).

The amount you can afford to spend doesn’t matter but it should be totally guilt free spending without any need to justify the purchase. But once its gone, its gone until the next pay day. No top ups!

Spending money should roll over. If you don’t spend it, you can add it to next weeks. I find having strict spending money amounts makes you think about incidental purchases a lot more and certainly for us we just naturally started spending less.

What is your favourite way to make sure you stick to your budget? Share with me in the comments below.