Budgeting can be a bit overwhelming if you’re new to it or you’re needing to overhaul.

I need to completely re-do mine for 2022. We have a lot of new expenses and some which will no longer be around. We have a new mortgage to consider but also no more daycare/kinder fees.

I will also be assessing all our expenses to ensure they meet needs and if I can get cheaper deals.

I thought these simple steps could help you just to get started with your 2022 budget.

Step 1: Expenses

Write down all of your expenses!

When writing down all your expenses make sure you’re including EVERYTHING! Drivers license renewal, pet insurance, regular medical expenses, swimming lessons, rental agent fees, bank fees etc. https://moneysmart.gov.au is a great place to get lists of expenses if you think you’re forgetting something.

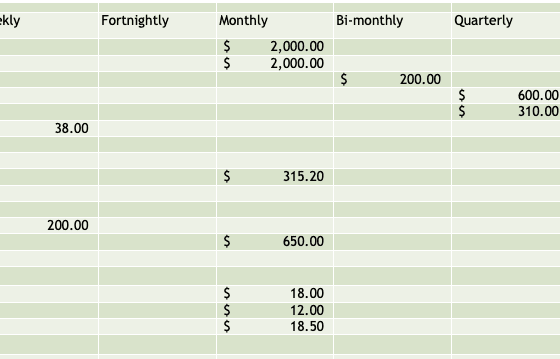

Now that you’ve got everything written down (notepad, excel, app…any way you want) you need to break the costs down into Equal time periods. I find it easiest to covert everything to monthly as that’s how I get paid.

Make sure you don’t fall for the “4 weeks in a month” trap. Don’t just divide or multiply an expense by 4. Here’s some examples of how to calculate your expenses.

Phone $50 per month. $50 x 12 (months) / 52 (weeks) = $11.53 per week.

Rent $590 per week. $590 x 52 (weeks) / 12 (months) = $2556.66 per month

For expenses which fluctuate, like electricity, calculate the yearly cost and divide.

For example

Electricity:

Qtr 1: $610

Qtr 2: $340

Qtr 3: $400

Qtr 4: $630

$610 + $340 + $400 + $630 = $1980

$1980 / 52 (weeks) = $38 per week.

There are actually lots of ways to do the maths but I have tried to keep it simple here. If you prefer another way, absolutely go with that. I actually have the calculations all entered in my spread sheet so it takes me just minutes to type in my new figures.

Step 2: Income

Similarly to expenses, write down ALL income. Work, side hustle, Centrelink, child support, rental income, dividends etc. If the income isn’t set in stone then estimate low or if it’s really iffy perhaps leave that out and treat as a bonus.

For us, income is the hardest issue for budgeting. We are both self employed. We truly have no idea what we will earn. If you run a business or earn commission based income, I recommend trying to save up 2-3 months desired income in a seperate account and then pay yourself a set figure monthly (or however). Replenish that account every month when you know what profits you have. If it’s less, make that up next month by adding more. Always add more if possible. That way, if you get a zero profit month or hit hard times, you’re covered. If the account builds up to be heaps then you can withdraw a ‘bonus’!

Work out your income for the budget period you want to work to (weekly, monthly, fortnightly). the calculations here are pretty simple but here are some examples.

Work Income $4000 per month. $4000 x 12 (months) / 52 (weeks) = $923.07 per week.

Centrelink income $230 per fortnight. $230 x 26 (fortnights) = $5980 per year.

Yearly Bonus $5000 per annum. $5000 / 52 (weeks) = $96.15 per week.

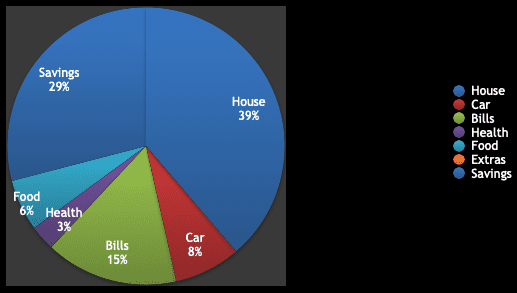

Step 3: Finalising Your 2022 Budget

Once you have broken down all your expenses to match your pay period you’ll now easily be able to see if your income can cover it.

If your income can’t cover it take a look over your expenses and see if you can cut anything out or down or if something is flexible.

Maybe you have Netflix and Stan. Consider flicking between them instead. So 1-2 months of Netflix then switch the Stan. You could also find discounted gift cards to pay for these services and reduce the overall cost.

If you want more ideas on how to lower your expenses check out this blog post.

For ideas on how to stick to your budget check our this blog post.

Make sure to follow me on facebook to see my 2022 budget progress.